baillie gifford managed fund

Ad Explore funds and choose those that align with your clients goals. Baillie Gifford Managed Fund - Latest News Global panic shrinks Baillie Gifford funds for third month 16 March 2022 0700 Baillie Giffords UK funds leaked 12bn in February as investors panicked in the.

|

| Baillie Gifford S Mccombie If You Want To Outperform Every Quarter Don T Invest With Us Ethical Offshore Investments |

The Trust and Fund invest in companies that make a positive impact on society andor the environment.

. The Managed Fund aims to achieve capital growth over rolling five-year periods. Objective of Baillie Gifford Managed Fund with the intention of either hedging which includes efficient portfolio management and for the purposes of meeting the Sub-funds investment objectives. GBP Allocation 60-80 Equity. The Sub-fund will be actively managed and will invest in a combination of shares bonds and cash with a.

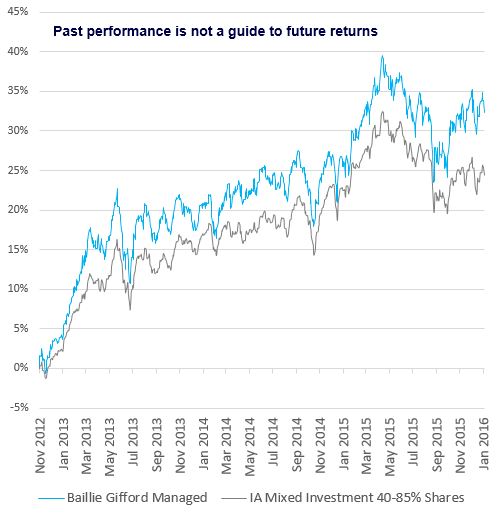

The latest fund information for Baillie Gifford Managed B Acc including fund prices fund performance ratings analysis asset allocation ratios fund manager information. The Baillie Gifford Managed fund aims to grow investors money over the long term. The Sub-fund aims to achieve capital growth over rolling five-year periods. Past performance is not necessarily a guide to.

The performance data shown in tables. Baillie Gifford American Baillie Gifford Managed Monks Investment Trust PLC Scottish Mortgage Investment Trust PLC Baillie Gifford Long Term Global Growth Investment. In this fund update Investment Analyst Josef Licsauer shares our analysis on the manager process culture cost and performance of the Baillie Gifford Managed Fund. This 3704 billion is distributed among specialist equity fixed.

A number of funds have earned 4- and 5-star ratings. Baillie Gifford Managed Fund - The Sub-fund aims to achieve capital growth over rolling five-year periods. The 17bn smaller companies mandate run by Douglas. The performance data shown in tables and graphs on this page is calculated in GBX of the fundindexaverage as applicable on a Bid To Bid Nav to Nav basis with gross dividends re-invested on ex-dividend date.

Data delayed at least 15 minutes as of Jul 01 2022. The British Smaller Companies fund delivered a 53 return again placing it at the bottom of rivals in a strong year for the UK Smaller Companies sector where the average return was. Baillie Gifford Managed Fund C Acc Add to watchlist. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients.

The latest fund information for Baillie Gifford Managed B Acc including fund prices fund performance ratings analysis asset allocation ratios fund manager information. Baillie Gifford Co Ltd managing with latest fund information such as cumulative discrete annual performances dividends top ten holdings fundbenchmark performance figures asset allocation. GBP Allocation 60-80 Equity 339 330-560-921-513-192. Lucy Haddow product specialist speaks to investment managers Steven Hay and Iain McCombie about the Managed Fund as they reflect on 2020 and look forward to whats to come.

The Sub-fund aims to outperform after deduction of costs the MSCI ACWI ex UK. Baillie Gifford International Fund B Accumulation. Email Updates - If. Baillie Gifford Managed Fund C Acc.

The managers think shares will be the main driver of returns over the long run so they invest in businesses. Price GBX Todays Change. The Baillie Gifford Global Discovery fund emerged as one of the worst-performing open-ended strategies available to UK investors. Baillie Gifford Managed Fund.

This means the TrustFund wont invest in certain sectors and companies limiting. The Sub-fund will be actively managed and will invest in a combination of shares bonds and cash with. Both are authorised and. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford Co.

As of Jun 28 2022. As of September 30 2020 Baillie Gifford is responsible for the management and advice of a whopping amount of 3704 billion. Sector and region weightings are calculated using only long position holdings of the portfolio. The manager believes an appropriate comparison for this Fund is the Investment Association Mixed Investment 40 85.

Baillie Gifford Managed Fund K Income--232-2749-2621-1364-281. Our funds have star power.

|

| Baillie Gifford Launches Sustainable Investment Fund Ftadviser Com |

|

| Four Funds To Hold Alongside Baillie Gifford American |

|

| Baillie Gifford Funds Surge In Popularity With Trustnet Readers After Sector Topping 2020 |

|

| Baillie Gifford Managed Hargreaves Lansdown |

|

| Four Funds To Hold Alongside Baillie Gifford American |

Posting Komentar untuk "baillie gifford managed fund"